cayman islands tax residency

There are no direct taxation laws in the Cayman Islands and therefore there are no domestic provisions which define tax residence generally or which provide criteria for determining tax. When moving from a country that enforces taxation upon its citizens to the Cayman Islandsa country without direct taxthere are certain rules and regulations that need to be adhered to in relation to your home country.

The Cayman Island Dual Luxury World Second Passport Citizenship Residency By Investment

Last updated 02 February 2022.

. Last updated 19 March 2020. Capital Gains Tax CGT for Non-UK Residents. The Department for International Tax Cooperation is a department in the Ministry of Financial Services and Commerce.

In addition to having no corporate tax the Cayman Islands impose no direct taxes whatsoever on residents. Here we discuss the differences between the. For each dependent named in the Certificate there is also a fee of CI1000 US121951 per annum.

Becoming a resident of the Cayman Islands is therefore an interesting option for wealthy people seeking to lower their tax bills by moving to a highly livable country. To reside in Grand Cayman the person must show proof of an annual. Entities engaged in scheduled trade and business in the Cayman Islands as defined in the Trade Business Licensing Law are required to have a.

The Cayman Islands is a well-known tax haven where you can establish residency without much hassle and as a British Overseas Territory it offers high-quality legal services health care and education. They have no income tax no property taxes no capital gains taxes no payroll taxes and. The Cayman Islands laws allow the location to be a tax haven through the fact that there is no corporate income tax no payroll tax or Cayman Islands capital gains tax and no other direct taxes for companies.

In particular one can apply to the Director of WORC for a Residency Certificate which is valid for 25 years and is renewable. But assuming you fit the requirements it all comes with a long-term residency program and a variety of privileges. The list below summarizes some of its characteristics more specifically the types of.

Tax Status for Expats. In light of the fact that banksfinancial services providers in the Cayman Islands USA EU and other compliant countries have very strict measures in place to verify the source of funds and customers and considering that virtually 100 of funds involved in broker-assisted property. The benefits of owning a property in a tax-neutral well-regulated jurisdiction with modern infrastructure is of increasing importanceCayman has proven itself as one of the worlds leaders in keeping its residents safe throughout the COVID-19 crisis.

14 hours agoSomething regarding the reports and risk assessments amounts to a crock of dung. For the purposes of the Common Reporting Standard CRS all matters in connection with residence are determined in accordance with the CRS and its Commentaries. This may be relevant or desirable for citizens of European Union EU member states for the purposes of compliance with Reporting of Savings Income Information Law.

The fee to make an application for a Residency Certificate for Persons of Independent Means is CI500 US60975 and if the application is approved there is an issue fee of CI20000 US2439024. The Cayman Tax Information Authority can grant tax residency certificates to individuals ordinarily resident in the Cayman Islands. If you fail the conditions to split the tax year into resident and non-resident periods you will be treated as resident in the UK.

While it is a low tax environment entry requirements are steep. Demonstrate that they have invested CI 2000000US 2400000 in developed real estate in the Cayman Islands. Cayman Islands Residence by Investment programs.

The Cayman Islands tax system is one of the most advantageous for investors. This category of long-term residence is different from the others in that it affords the holder full permanent residence in the Cayman Islands. In an increasingly volatile world acquiring residency in the Cayman Islands is an appealing opportunity for high-net-worth individuals.

Requirements include the following. Becoming a resident of the Cayman Islands is therefore an interesting option for wealthy people seeking to lower their tax bills by moving to a highly livable country. The Cayman Islands does have a double tax treaty with the UK but it is narrowly drafted and therefore can only be relied upon in certain limited circumstances.

The Cayman Islands provide investors with permanent or long term resident permit under the Independent Means category. For foreign nationals not wishing to work in the Cayman Islands but simply wishing to have the right to reside there are alternative options. Since no corporate income capital gains payroll or other direct taxes are currently imposed on corporations in the Cayman Islands corporate residency is not relevant in the context of Cayman Islands taxation.

It is responsible for administering all of the Cayman Islands legal frameworks for international cooperation in tax matters and for carrying out the functions of the Tax Information Authority the Cayman Islands competent. The Cayman Islands is a well-known tax haven where you can establish residency without much hassle and as a British Overseas Territory it offers high-quality legal services health care and education.

Work Remotely From The Cayman Islands For Up To Two Years

Incorporating In The Cayman Islands Tmf Group

Cayman Islands Residency By Investment Tax Efficient Residency

Cayman Islands Residence By Investment Programs

The Cayman Islands Residency By Investment Programme Latitude

A Guide To The Benefits Of Cayman Islands Residency Investment Migration Insider

Cayman Islands Cayman Island Grand Cayman Island Caribbean Islands

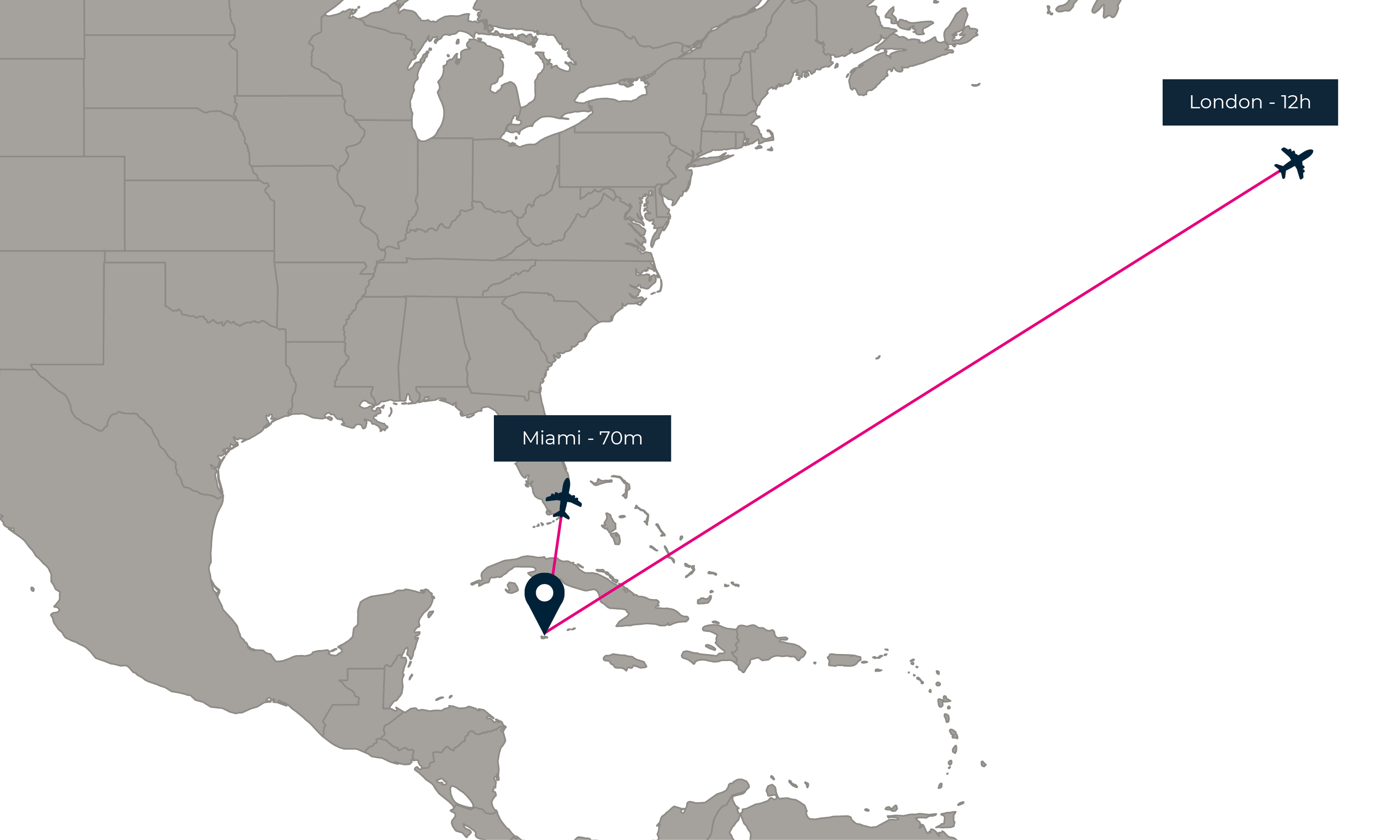

How To Get Cayman Islands Residency 7th Heaven Properties

How To Get Cayman Islands Residency And Pay Zero Tax

The Cayman Islands A Jurisdiction Of Choice For Residency By Investment Through Real Estate Youtube

How To Get Cayman Islands Residency 7th Heaven Properties

Buying Property In The Cayman Islands Provenance Properties

How To Get Cayman Islands Residency And Pay Zero Tax

How To Get Cayman Islands Residency And Pay Zero Tax

How To Move Your Business To Cayman And Pay No Tax Escape Artist

Cayman Islands Company Formation Services Hermes Bvi Cayman Islands Cayman

The Cayman Islands Residency By Investment Programme Latitude